Many people don’t even know where to begin when it comes to enrolling in their employer’s 401(k) or 403(b) programs, let alone choosing their investments. Here, I show an example of how one would do this at my employer, University of Central Florida (UCF).

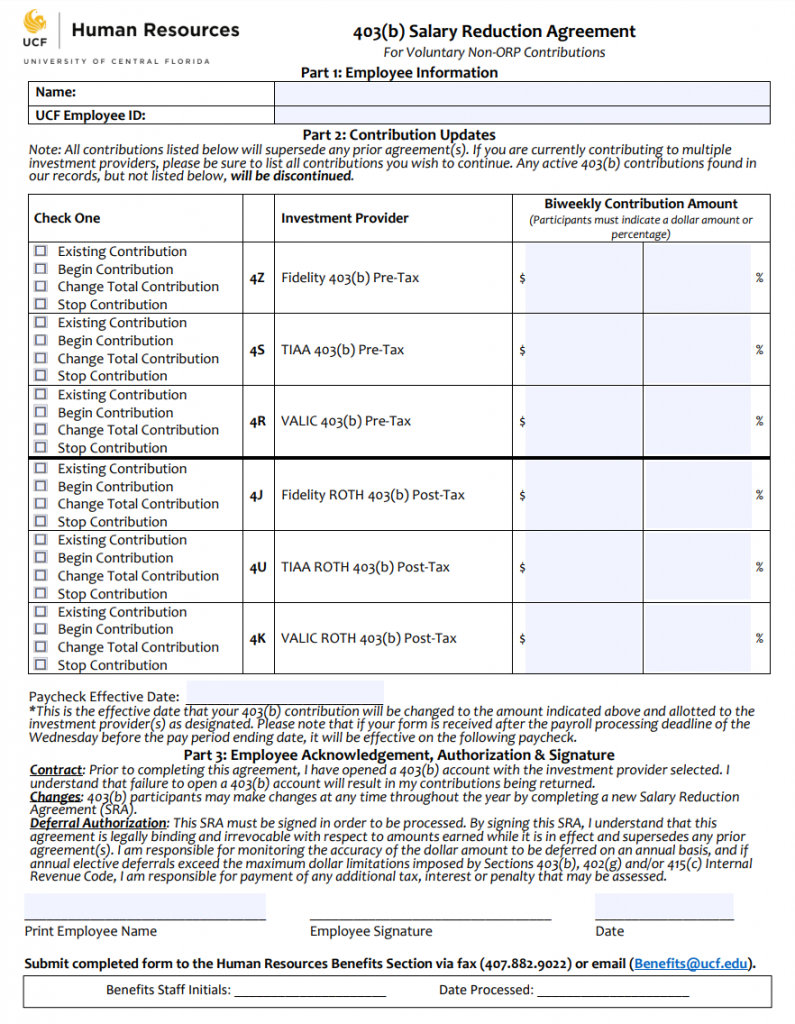

First, you would seek out this one-page guide from UCF and choose one of three investment providers. I prefer Fidelity, which, like the others, has a portal to aid UCF employees in opening their account. After applying for an account at your chosen provider, at UCF you would complete the Salary Reduction Agreement form and submit it to the HR department. Because UCF is a public school (university), the plan is called a 403(b) instead of a 401(k), but is basically the same. When you put money into such plans, you generally cannot access it until Age 59.5 or older without incurring substantial penalties, so you should pay off high-interest debt and have a substantial emergency fund in an FDIC-insured savings account first.

The form, pictured above, has several options. First, you must decide if you want to make pre-tax (traditional) or post-tax (Roth) contributions, or a combination of the two. Generally, low earners should use post-tax (Roth) contributions because they are in a low tax bracket, while high-earners should use pre-tax (traditional) contributions to reduce their present tax burden. Second, you must choose an investment provider. UCF offers Fidelity, TIAA, and VALIC. Personally, I prefer Fidelity from these three, although I would pick Vanguard if it was available.