Investing in the stock market is fundamentally risky. Although in 2018, capitalization-weighted stock market index funds with small expense ratios are finally approaching ubiquity, the risk of an investment in the whole U.S. stock market losing nominal dollars in any one particular calendar year is nonetheless about 25% (this is similar for the S&P 500, which by market cap is almost 90% of the U.S. stock market). Of course, the risk of losing nominal dollars in a bank account, certificate of deposit (CD), or Treasury bill in any one particular year is 0%. For a capitalization-weighted bond market index fund, the risk is greater than 0% but much less than 25%.

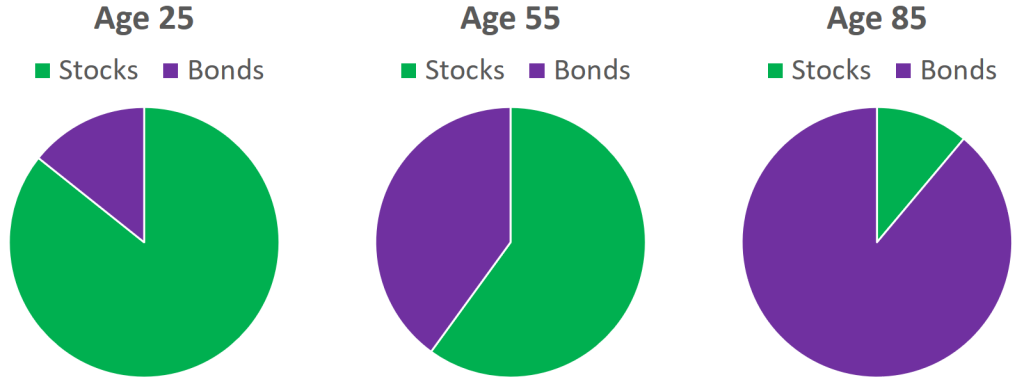

Based on this volatility, standard, “time-tested” investment advice is to reduce one’s proportional exposure to stocks as one ages. Considering stocks and bonds, the two major classes of investments, authors and financial advisors often advise portfolio allocations looking something like this based on a person’s age:

This is the “glide path” by which one reduces exposure to risk as he or she ages, accumulates wealth, and eventually stops working. The theory is that in youth and middle age, you can fall back on your earnings and many remaining decades of life. Although you will make money in about 75% of one-year periods in U.S. stocks, you will make money in 100% of 30-year periods. That is to say, over longer time horizons, U.S. stocks always outperform bank accounts, CDs, T-bills, and bonds. Because people who are still working can live off their earned income, in theory there should be no reason to withdraw money from your investments in capitalization-weighted stock market index funds until you retire. This would include stock investments in your individual retirement arrangements (IRAs), 401(k) or equivalent accounts, health savings accounts (HSAs), and taxable brokerage accounts.

A Litany of Problematic Assumptions

Percentage-based portfolio allocation recommendations are fundamentally stupid. In theory, they suggest that your investments should be of the same proportions whether you have $1,000 or $1,000,000,000. There is no accounting for human behavioral foibles nor your portfolio size, earnings, living expenses, future living expenses, retirement target date, or legacy.

Human Behavioral Foibles

Although a younger person should be more tolerant of risk, it is actually more likely that they will sell their investments out of fear when the U.S. stock market drops. While a good financial advisor might talk them out of such foolishness, it is necessary for a young person to fully comprehend the nature of the stock market. Otherwise, they are likely to sell at the worst possible time (i.e., the next recession) and never buy back in due to psychological trauma.

Sequence risk is the primary, existential threat to a retiree’s portfolio. If the next Great Recession occurs right at the start of your retirement, you could wind up destitute if you follow Dave Ramsey’s clownish advice that you can count on 12% annualized market returns and an 8% annual withdrawal rate in retirement (both of Dave’s suggestions are manifestly, positively, 100% wrong). If the market tanks by 50% and you then withdraw 8% of the pre-crash value, you are down not 58% from your initial portfolio size, but 66%. With 34% of your initial investment remaining, you would now need your portfolio to triple just to get back to the starting point. In a nutshell, this is sequence-of-returns risk.

Because no one can time the market with consistency and accuracy, competent financial advisors suggest a 4% annual withdrawal rate. Although this sounds overly conservative, the conservatism is necessary to account for the possibility of a market downturn early in retirement. In the majority of scenarios, a retiree should die with more money than they started retirement with, because there is no way to time the market. Consequently, it is impossible to plan things out so one runs out of money just as they kick the bucket.

Unless…

Percentage-based portfolio allocations suggest moving increasing proportions of your money into low-risk, low-yield investments as you age. Although financial advisors actually consider (or, should consider) your personal situation, it is nonetheless pervasive that blanket percentage-based “rules of thumb” be proffered based on one’s age, such as “invest your age in bonds.” These recommendations are often misguided and, frankly, preposterous. They unnecessarily assure diminished returns in middle and old age.

Not Accounting for Portfolio Size and Living Expenses

The size of your portfolio and your living expenses are actually critical factors in the proportion of your portfolio that you invest in stocks. If, in retirement, your living expenses are more than covered by Social Security and a pension, you might continue to invest 100% or most of your portfolio in stocks, because even if the market tanks, you don’t need to withdraw any money. After human behavioral foibles, the second biggest risk of investing in stocks is that you might have to take your money out during a recession. If the timing of deposits and withdrawals is stochastic (i.e., random, with no consideration of market value), then the duration of investment is the determinant factor in returns, with respect to the U.S. stock market or global stock market.

Of course, among American investors (and others), the timing of deposits and withdrawals is not stochastic. People tend to withdraw money during a recession, often because of psychology, poor planning, and job loss. People put more money in at the market’s peak, rather than as the money becomes available to them.

Say that your living expenses are $40,000 per year and your portfolio is worth $2,000,000. Then, 4% of $2 million is $80,000, which is double your living expenses. If you are Age 65 and having most of this $2 million in bonds, you will miss out on tremendous returns in old age, which might extend into your 90s. On the other hand, you could have 80% of the $2 million in stocks and, even in the worst scenario, not need to liquidate stocks for 10 years by withdrawing the proportion of your portfolio ($400,000) invested in bonds. (When stocks go down, bonds do not tend to similarly decline.) Living expenses also trend lower in a recession, and you may have other income from Social Security, et cetera.

On the other hand, if you have the same retirement portfolio but need $200,000 per year to live, neither a conservative nor aggressive allocation will suffice, because your expenses are simply too high (or, alternately, your portfolio size is too small).

Future Living Expenses

Your future living expenses are also something to consider. They could go up or down in retirement. A common observation is that living expenses tend to go down after Age 80 or so (although, of course, medical expenses can go way up). If your living expenses are going to decline drastically, such as due to downsizing your home and no longer having to pay for children’s college expenses, your portfolio can be more aggressive (a larger proportion in stocks) because you will not need to withdraw as much.

Retirement Target Date

Becoming financially independent and retiring early (FIRE) is popular among a small section of Americans who read Mr. Money Mustache and other authors. The 4% rule is not about winding up with $0 after 30 years—it is aimed at indefinite sustainability. This is why FIRE hopefuls are so concerned with cutting expenses. Cutting $1,000 out of your annual expenses means you are financially independent (i.e., your portfolio can indefinitely sustain itself) with $25,000 less. If your annual expenses are $40,000, you can usually be financially independent with $1 million, but if you can cut your expenses to $20,000, you only need $500,000. The bulk of your portfolio should be invested in stocks, and you should be prepared to spend less or earn more (a “soft retirement”) if the market declines early in your retirement (sequence risk). On the other hand, if the market increases, this will not be necessary.

Percentage-based portfolio recommendations fail to consider any of these factors.

Legacy

Fundamentally, this is the same problem that Harvard University’s endowment and the Nobel Foundation face. The manner in which both of these learned institutions handle their portfolio is spectacularly terrible. They insist on employing highly paid fund managers in the fruitless and detrimental pursuit of picking stocks and timing the market, rather than passively investing in the whole market. Then, we have the Nobel Foundation going on the record in 2012 saying they expect low equities returns in the future, which of course was followed by tremendous returns, showing that market predictions are often wrong. Although a passive index-investor had tremendous returns since 2012, it is likely that Harvard, the Nobel Foundation, and others had lower returns due to their active investing practices.

It is misguided to tell someone to invest a certain proportion of their portfolio in stocks without specifying that this money should be in an S&P 500 or broader, low-fee index fund. Certainly, many endowment managers invest a large proportion in stocks, yet their returns are muted due to trying to pick stocks and sectors, and not investing for the long haul. This is called the investor gap. When a foundation’s investment time horizon is basically eternity, it is inexcusable for their assets to be so spectacularly mismanaged.

Sadly, misinformation on the Internet is widespread. Many thousands of websites suggest that active management, picking market sectors, and timing the markets are worthwhile, simply because stockbrokers profit from charging load fees, transaction fees, and management fees. These practices are diametrically opposed to leaving a financial legacy to heirs or charity. Like many other issues, they are not addressed in mainstream portfolio advice.

One pingback