Many people don’t even know where to begin when it comes to enrolling in their employer’s 401(k) or 403(b) programs, let alone choosing their investments. Here, I show an example of how one would do this at my employer, University of Central Florida (UCF).

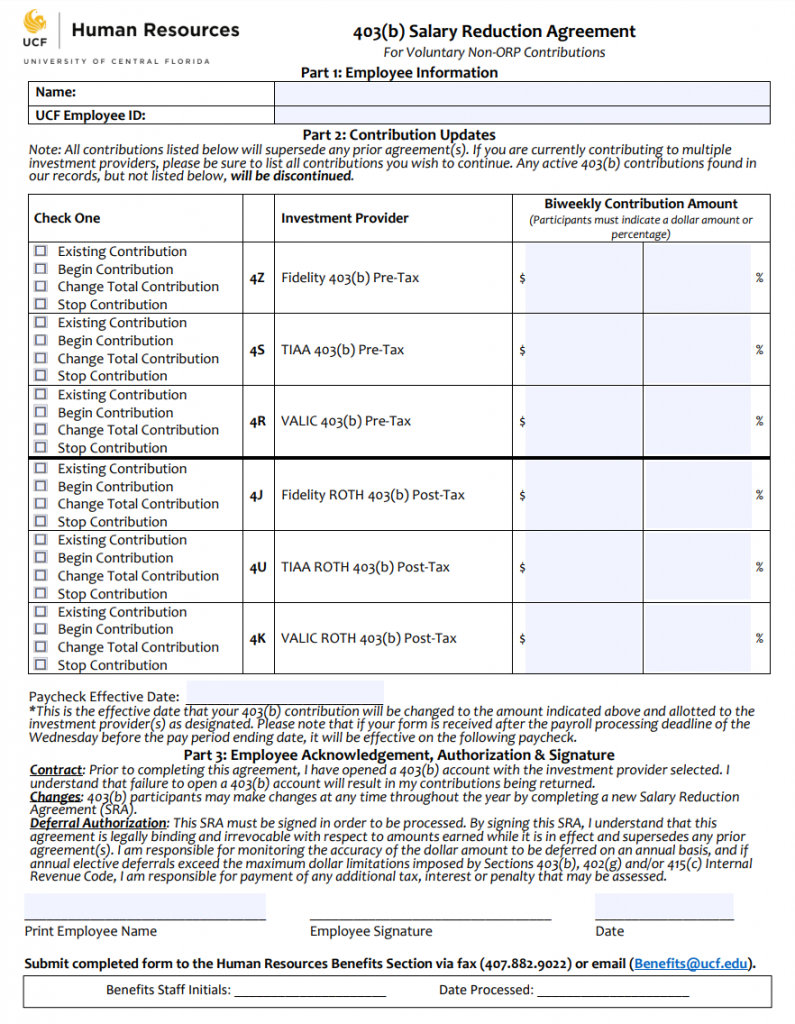

First, you would seek out this one-page guide from UCF and choose one of three investment providers. I prefer Fidelity, which, like the others, has a portal to aid UCF employees in opening their account. After applying for an account at your chosen provider, at UCF you would complete the Salary Reduction Agreement form and submit it to the HR department. Because UCF is a public school (university), the plan is called a 403(b) instead of a 401(k), but is basically the same. When you put money into such plans, you generally cannot access it until Age 59.5 or older without incurring substantial penalties, so you should pay off high-interest debt and have a substantial emergency fund in an FDIC-insured savings account first.

The form, pictured above, has several options. First, you must decide if you want to make pre-tax (traditional) or post-tax (Roth) contributions, or a combination of the two. Generally, low earners should use post-tax (Roth) contributions because they are in a low tax bracket, while high-earners should use pre-tax (traditional) contributions to reduce their present tax burden. Second, you must choose an investment provider. UCF offers Fidelity, TIAA, and VALIC. Personally, I prefer Fidelity from these three, although I would pick Vanguard if it was available.

Third, you would check “Begin Contribution” if it was your first time setting up your 403(b), and then indicate a fixed dollar amount or percentage of your paycheck. For those under 50, in 2018, you can contribute up to $18,500 to your 403(b). You can file another form with HR at a later date to change your contribution amounts for future paychecks, so if you are just starting to contribute late in the year, one option is to contribute as much as 100% of your paycheck, and then adjust the percentage downward next year to avoid going over the maximum. Of course, very few people are able to contribute the annual maximum.

Fourth, you indicate the paycheck effective date, print and sign, and date the form. The form must be filed in advance, so you may have to wait until the next pay cycle for your contributions to begin. Some employers may use a web interface instead of a PDF form to begin and/or change your 403(b) contributions. Others may only have the form available in paper by request from HR, rather than being available online.

Your investment provider, in coordination with your employer, offers several options for investing your contributions. Pictured below are the 31 investment options offered by UCF and Fidelity. Note that by default, Fidelity displays the average annualized returns over the past year, three years, five years, and 10 years. This information is irrelevant and a distraction. Picking passively managed index funds is the best approach, which simply track the overall stock market or a segment thereof. Therefore, returns for these funds just reflect what the market as a whole returned in past years. If you were to pick an actively managed fund based on its returns, that would be an inferior choice.

When we click over to the Fees tab, below, we see information that is much more relevant and important:

Above, we see that the actively managed stock funds charge ridiculous fees ranging from 0.65% to 1.19% per year, while the index and target-date funds (another type of index fund), which are passively managed, range from 0.015% to 0.2% in annual fees. The highest fee here is still less than a third of the lowest actively managed fund! Even before considering fees, it’s a toss-up whether an actively managed fund will beat a passively managed fund. When we take fees into account, passively managed funds are overwhelmingly superior. (Note: Although one actively managed fund has a 0.1% annual fee, this is a “stable value” fund that will produce very low returns over the long haul, which is antithetical to long-term retirement investing.)

From the above list, I chose FUSVX, which invests in 500 of the largest U.S. companies proportionate to their total value or “market cap” (i.e., Apple, Microsoft, Amazon, Google, etc.). The Standard & Poor’s 500 is representative of “large cap” companies in the United States, which is a bit heavy on technology companies. In many ways, it is an equally valid choice to invest in mid-cap, small-cap, and/or international funds, and depends on personal preferences. Many people advocate for investing more of your money in small-cap companies. Many people also recommend investing a proportion of your stock investments, ranging from 10% to 50%, in an international index fund. Such funds usually consist of publicly listed companies in every country except the United States (i.e., Shell, Tencent, Nestle, Samsung, Alibaba, etc.).

If it was available, I would choose the Vanguard Total Stock Market fund instead of FUSVX. However, it is very common for 401(k) and 403(b) plans to offer a limited menu of funds, with most of them being bad choices. UCF’s index-fund offerings are excellent, when compared to many employers.

Note that in the above menu we see a “socially responsible” option: The Vanguard FTSE Social fund, with 0.20% annual fees. Such funds avoid certain companies like ExxonMobil, Chevron, Philip Morris, and Wells Fargo that promote climate change, smoking, or financial crimes. However, these funds tend to produce lower returns in the long run, and have higher fees. Although Vanguard keeps their fees as low as possible, 0.20% is quite a bit higher than 0.015% seen with the S&P 500 option. One argument is that it would be better to reap the profits of investing in evil companies and then donate a portion of your capital gains to non-profit organizations. The VFTSX fund notably still invests in many large banks and soda companies (i.e., Coca-Cola). Also, remember that by investing in index funds, you have already given up your shareholder voting rights. Vanguard, Fidelity, and others cast votes at shareholder meetings without your say, and tend to side with what corporate management wants.

Many people don’t know this, but even UCF graduate students working as graduate assistants can contribute up to 100% of their assistantship stipend to a 403(b) plan through the above procedures. Although a match isn’t offered, this is a great way to get a jump-start on retirement contributions via Roth contributions, so that you owe no capital gains tax in retirement and take advantage of many decades of compounding returns. Of course, most graduate students can’t afford the luxury of a voluntarily reducing their salaries… which is why tax-advantaged retirement accounts in practice, sadly, perpetuate financial inequality. I have not looked into whether UCF allows undergraduate work–study students to contribute to a 403(b). Notably, the laws on 403(b) plans actually allow colleges and universities to exclude students from them, including graduate assistants, so it is fortunate that UCF allows graduate assistants to contribute to 403(b) plans. Of course, an individual retirement arrangement (IRA) is always an option for someone with earned income (unless they make over $135,000), but these are capped at $5,500 per year. You set up an IRA on your own (not through your employer), and can do so at Fidelity, Vanguard, or elsewhere.

From the Fidelity/UCF 403(b) menu, we can choose several target-date funds, which use a “glide path” that shifts your assets from stocks to bonds as you get closer to retirement. Stocks are more volatile—the worst recent example is October 2007 to March 2009, where you would have lost over 55% of your money had you invested in the “stock investments” listed above! Despite this, from October 2007 to August 2018 you would be up over 100%. This is one of many examples of how stocks produce large returns over long timeframes. If you won’t need your money for over 30 years, going 100% stocks makes sense. However, as you get closer to the time when you will need your money, shifting to bonds (e.g., U.S. Treasury bonds) reduces the risk of negative impacts from a market crash coinciding with your retirement. This is what the target-date funds do. Although target-date funds are blunt instruments, it would be a fine decision for someone my age, 27, to invest in the 2050, 2055, or 2060 Vanguard target-date funds. Doing this would still put a young person far ahead of most young people, who don’t have the spare funds to invest for retirement at all.

If you have credit card debt, you may be paying as much as 28% per year on it. Contributing to a 401(k) or 403(b) is less urgent than paying off your credit card debt. You should pay off your credit card debt first. Even in 2017, an amazing, unusual, phenomenal year for stocks, the S&P 500 gained about 22%. It could have declined 22% (it declined 22% in 2002, and 37% in 2008). Paying off debt is a guaranteed return, while investments are not. Investing isn’t gambling, because the odds are in your favor, unlike at a casino. However, you will still have plenty of losing years. But, over 30 years or more, the probability of you coming out ahead, even after accounting for inflation, is close to 100%. With 401(k), 403(b), and many other retirement savings plans, there are large tax penalties for taking money out before you turn 59.5 years old. This can serve as a commitment device. Although it does not prevent the very unwise choice of divesting your stocks into a bond or fixed-income fund during a market crash, you are unlikely to make a bad choice like this as you still wouldn’t be able to access the funds.

Another option for teachers and other state employees is a 457 plan. In Florida, you would go to www.myfloridadeferredcomp.com, a state website, to learn about this. There are five providers: Nationwide Retirement Solutions, Empower Retirement, VALIC, T. Rowe Price, and Voya. Here are the investments you could select for one provider, VALIC, according to the State of Florida’s most recent report.

As we see here, based on fees, VALIC has only one good option: The Vanguard Total Stock Market index fund, with fees of 0.04% per year. This fund invests in about 3,500 U.S. companies based on market cap, which results in about 80% overlap with an S&P 500 fund, but broader diversification—there are about 3,000 smaller stocks that an S&P 500 fund neglects completely. Given the choice, I would prefer this fund over an S&P 500 (but with the Fidelity/UCF 403[b] menu, recall that it wasn’t an option).

Looking through the state’s report, we see that target-date funds are also available for 457 plan members, but the same Vanguard target-date funds seen in the Fidelity/UCF 403(b) menu are offered by Voya tripled fees! This is horrible. The other target-date funds are no better, with some as high as 0.82% of annual fees. This doesn’t sound like much, but it adds up quickly over the years. Keep in mind that the stock market only returns about 10% a year on average, so a fee of 0.82% is actually more like 8%. Additionally, when we consider that target-date funds return less over the long haul because they contain bonds, the fees take an even larger bite. With the Fidelity/UCF 403(b) offerings, the fees were only 0.15% max, which is more reasonable. As you approach retirement, one option to avoid these fees would be to keep your 457 plan fully invested in VTSMX, while offsetting the risk by investing in bond funds elsewhere (e.g., your 403[b], IRA, and/or taxable brokerage accounts), where fees are lower. I recommend consulting with a competent, fee-based financial advisor accountable to the fiduciary standard.

Although since 2011, 457 plans can be offered in a Roth (post-tax) option, Florida only offers them in a traditional (pre-tax) option, meaning capital gains are taxed in retirement but your income is reduced in the present tax year. Amazingly, since 2002, limits for 457 plans are separate from 403(b) limits, which means someone under 50 could contribute $18,500 to each for a combined total of $37,000 in 2018, or $48,000 if above Age 50. Of course, it would be unusual for a teacher or other state employee to be able to contribute this much. This is in addition to the IRA limit of $5,500, which means one could contribute $42,500 per year if maxing out their 403(b), 457, and IRA, or $54,500 if above Age 50.

Investing for retirement is critical to achieving financial independence. I contend there are two primary reasons: compounding returns and tax avoidance. Retirement accounts give you a big tax break, and can also serve as a commitment device to dissuade you from cashing out early. However, they give you choices in where to invest your money. Many of these choices are bad. Actively managed funds offer a double whammy of high fees and capital gains that are often lower than the overall stock market. About half of Americans have no stock investments, which is terrible. Unfortunately, even among the half that do invest in stocks, many Americans are losing tons of money compared to what they would receive, over the long term, by investing in VTSMX or FUSVX. Others, still, relegate their retirement accounts to “safe” bond or fixed-income investments, which is devastating in the long run. This negatively impacts women in particular; there is a large gender–investing gap that may even be of more significance than the gender–pay gap. Although nearly everyone is deficient in financial literacy, educating girls and women on personal finance is critical, along with lobbying against mendacious corporate and governmental practices.